IJV is a cash-and-carry show. International jewelers are allowed to sell their exhibits on show floor (paid in US$ or Vietnamese Dong). Customs duties, taxes and VAT are only applied on sold items that will be settled with the customs officers on the last day of exhibition through the official forwarder and broker. Starting from January 2011, the Import & sales VAT + corp. income tax has been reduced to 13%. The duty of CEPT/ATIGA, ACFTA and AKFTA in all jewelry items has been decreased to 0% started from January 2015.

There are 4 kinds of Import Duty/Taxes relevant to Exhibitors regarding their participation in the Fair and these are:

- Import Duty

- Import VAT

- Sales VAT; and

- Corporate Income Tax.

These all apply on Exhibits SOLD at the Fair and declared Gift.

1) Import Duty & Import VAT:

Calculation method:

- Import Duty: Invoice CIF Price x Applicable Import Duty %

- Import VAT: (Invoice CIF Price + Import Duty) x VAT %

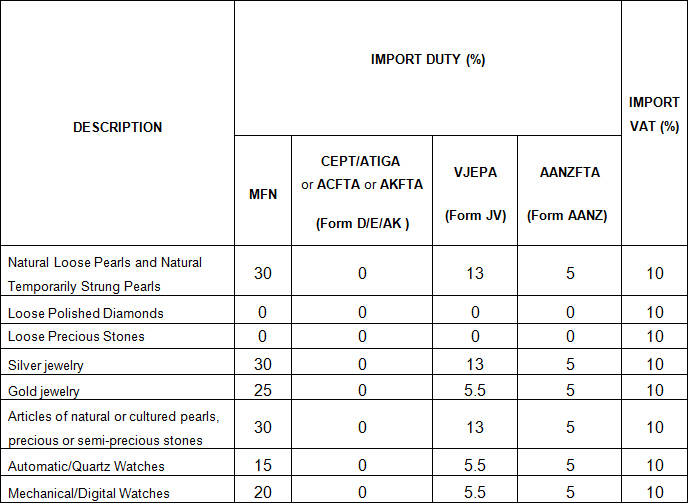

LIST OF IMPORT DUTY AND IMPORT VAT RATES (SUBJECT TO CHANGE IN CUSTOMS REGULATIONS)

Exhibitors who plan to bring in different Exhibits to the Fair other than shown above are required to contact the official customs broker in advance so that clarification can be made with Customs on the applicable rates to be applied and also whether such items are actually legally able to be brought into Vietnam.

As shown above, the Import Duty Rate to be applied varies depending on their origin:

- MFN: for MFN (Most Favoured Nation) list of countries.

- CEPT/ATIGA: for goods imported from ASEAN (10 countries) under AFTA scheduled from 2015-2018. C/O Form D is required.

- ACFTA: under the Commercial Agreement between ASEAN-CHINA applied to goods imported from ASEAN + CHINA. C/O Form E is required. C/O Form E is not accepted for shipment originally departing from Hong Kong.

- AKFTA: under the Commercial Agreement between ASEAN-KOREA applied to goods imported from ASEAN + KOREA. C/O Form AK is required.

- VJEPA: under the Commercial Agreement between VIETNAM-JAPAN applied to goods imported from JAPAN. C/O Form JV is required.

- AANZFTA: under the Commercial Agreement between ASEAN-AUSTRALIA-NEW ZEALAND applied to goods imported from ASEAN-AUSTRALIA-NEW ZEALAND. C/O Form AANZ is required.

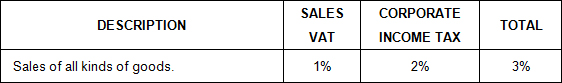

2. Sales VAT and Corporate Income Tax

The outline for applicable Sales VAT and Corporate Income Tax is calculated as a % of the total Sales Turnover by the Exhibitor at the Fair:

|

|